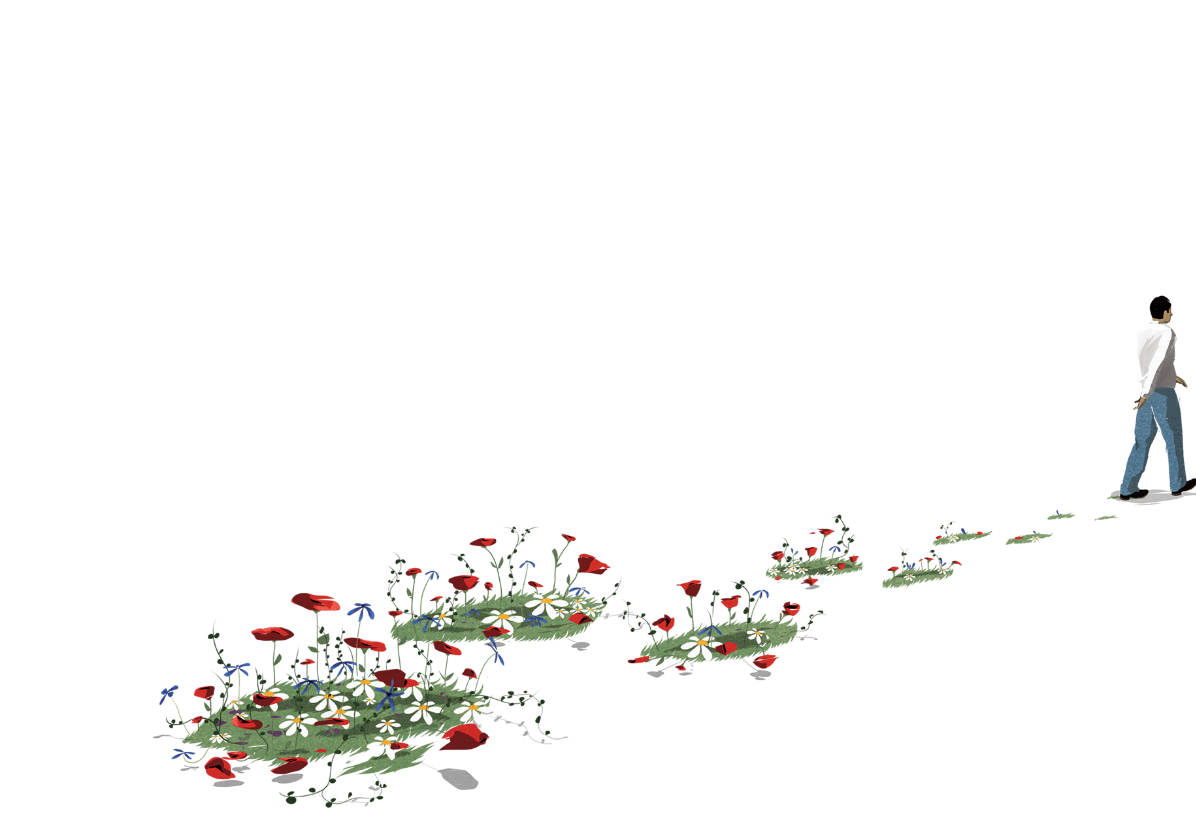

Judge us by what we leave behind

Judge us by what we leave behind

Axcel CV

Companies

Axcel VII

Investors by type

Investors by region

Companies

Company

Country

Invested

Exit

Fund

Norway

2026

Axcel VII

Iceland

2025

Axcel VII

Sweden

2025

Axcel VII

Sweden

2025

Axcel VII

Sweden

2024

Axcel VII

Sweden

2024

Axcel VII

Denmark

2023

Axcel VII

Sweden

2023

Axcel VII

Sweden

2023

Axcel VII

Sweden

2025

Axcel VII

Axcel VI

Investors by type

Investors by region

Companies

Company

Country

Invested

Exit

Fund

Sweden

2022

Axcel VI

Sweden

2022

Axcel VI

Denmark

2022

Axcel VI

Denmark

2022

Axcel VI

Denmark

2022

Axcel VI

Denmark

2022

Axcel VI

Denmark

2022

Axcel VI

Denmark

2021

Axcel VI

Denmark

2021

Axcel VI

Denmark

2020

Axcel VI

Sweden

2020

Axcel VI

SuperOffice

Norway

2020

2025

Axcel VI

Axcel V

Investors by type

Investors by region

Companies

Company

Country

Invested

Exit

Fund

Denmark

2019

Axcel V

Denmark

2019

Axcel V

SteelSeries

Denmark

2019

2022

Axcel V

European Sperm Bank

Denmark

2019

2022

Axcel V

Loopia

Sweden

2018

2024

Axcel V

Denmark

2018

Axcel V

Aidian

Finland

2018

2022

Axcel V

IsaDora

Sweden

2018

2022

Axcel V

Nissens

Denmark

2017

2024

Axcel V

Mountain Top

Denmark

2017

2023

Axcel V

Axcel IV

Investors by type

Investors by region

Companies

Company

Country

Invested

Exit

Fund

Danish Ship Finance

Denmark

2016

2024

Axcel IV

Frontmatec

Denmark

2016

2022

Axcel IV

LESSOR Group

Denmark

2016

2018

Axcel IV

Conscia

Denmark

2015

2019

Axcel IV

Netel

Sweden

2013

2016

Axcel IV

EXHAUSTO

Denmark

2013

2016

Axcel IV

Delete Group

Finland

2013

2023

Axcel IV

EG

Denmark

2013

2019

Axcel IV

Silkeborg Data

Denmark

2013

2015

Axcel IV

Mita-Teknik

Denmark

2012

2019

Axcel IV

Nordic Waterproofing

Sweden

2011

2017

Axcel IV

Cimbria

Denmark

2011

2013

Axcel IV

Axcel III

Investors by type

Investors by region

Companies

Company

Country

Invested

Exit

Fund

LGT

Sweden

2009

2015

Axcel III

PANDORA

Denmark

2008

2014

Axcel III

Johan Bauer Education

Sweden

2008

2013

Axcel III

Ball Group

Denmark

2007

2019

Axcel III

IDdesign

Denmark

2007

2014

Axcel III

Noa Noa

Denmark

2007

2014

Axcel III

Driconeq

Sweden

2007

2018

Axcel III

Netcompany

Denmark

2006

2011

Axcel III

HusCompaniet

Denmark

2006

2011

Axcel III

TCM Group

Denmark

2006

2015

Axcel III

EskoArtwork

Belgium

2005

2011

Axcel III

Axcel II

Investors by type

Investors by region

Companies

Company

Country

Invested

Exit

Fund

Ellipse (DDD)

Denmark

2004

2010

Axcel II

Junckers Industrier

Denmark

2004

2014

Axcel II

Vest Wood

Denmark

2002

2005

Axcel II

NetTest

Denmark

2002

2005

Axcel II

Royal Copenhagen

Denmark

2001

2012

Axcel II

Glud & Marstrand

Denmark

2001

2005

Axcel II

Georg Jensen

Denmark

2001

2012

Axcel II

Aalborg Industries

Denmark

2000

2005

Axcel II

Icopal

Denmark

2000

2007

Axcel II

Vital Petfood Group

Denmark

2000

2014

Axcel II

Axcel I

Investors by type

Investors by region

Companies

Company

Country

Invested

Exit

Fund

Svenska Fönster

Denmark

2000

2003

Axcel I

Kwintet

Denmark

1999

2005

Axcel I

LOGSTOR

Denmark

1999

2006

Axcel I

Rationel Vinduer

Denmark

1998

2003

Axcel I

Kilroy Travels

Denmark

1998

2006

Axcel I

Thygesen Textile Group

Denmark

1998

2006

Axcel I

Laundry Systems Group

Denmark

1998

2006

Axcel I

BB Electronics

Denmark

1998

2016

Axcel I

GraphX

Denmark

1997

2003

Axcel I

Føvling

Denmark

1997

2002

Axcel I

Bekaert Handling Group

Denmark

1997

2005

Axcel I

Tvilum-Scanbirk

Denmark

1996

2000

Axcel I

Monarflex

Denmark

1995

2000

Axcel I

Yearbooks

Fund accounts

Policies

Axcel Management

Key Information Documents

See all Fund accounts